The question of whether a merger and acquisition (M&A) or divestiture will hit your organization is settled. It will and I’ll explain below. The real question is whether the department that carries the brunt of the M&A work is prepared: Information Technology.

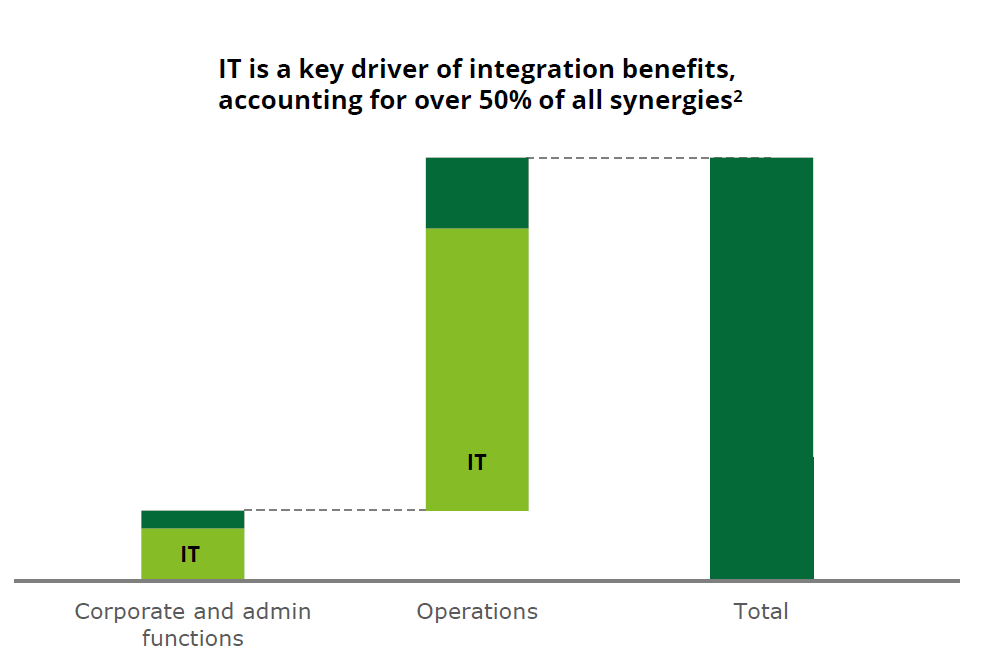

In this post, we’ll explore why IT integration is central to meeting the goals of an M&A and at least half of the expected cost synergies, and the challenges that can stand in the way of success. I’ll also provide a glimpse into how to prepare yourself for these M&As and where to get more information to make your IT integration a success.

This is Part 1 of our M&A C-Suite Series, aimed at our C-level audience responsible for the big decisions in a M&A to help them understand the impact Information Technology can have on meeting the cost-synergies they expect to see. Here are the topics for the rest of the series:

- Part 2: The M&A Costs for Excluding IT from Day Zero Activities

- Part 3: M&A IT Integration Sins Come Home to Roost During Legal Day One

- Part 4: M&A transition service agreements

- Part 5: The M&A Promised Land and other dangers post LD1

M&A activity is accelerating and IT integration is on the hook

Merger and acquisition (M&A) activity reached record levels in 2018, totaling $4 trillion. 2019 is projected to continue at the same pace. That’s a 19% increase over 2017 according to Thompson Reuters1. After all, M&A activity can help organizations expand their customer base, diversify their products and services, and acquire new technology to stay competitive. An awfully large sum of money is fronted to buy another company – and investors and the stock market want to see any of those three goals return significant cost synergies.

In order for organizations to meet any of those three goals, IT integration has to happen – getting employees of the different organizations working together, or in the case of a spin-off, ensuring they have the resources needed to focus on their core competencies.

All that starts with IT integration. In fact, 50% of cost synergies are expected to come from the IT integration process according to Deloitte2 (see figure below).

Combining the IT systems of the merging companies is a critical step toward making them one entity, realizing the synergies between them, and enabling strategic and cultural integration. Without technology integration, you just have two separate entities that report their revenue as one.

IT integration challenges in a M&A

Yet IT teams face special challenges in achieving the technology integration required by a merger or acquisition. These challenges can add time, costs, and lost productivity – all of which impact the cost synergies that need to happen here. Let’s take a look at a few of these:

- Strict Transition Service Agreements (TSAs)

- Importance: Established when the deal is inked, these contracts dictate strict deadlines to carry out the IT integration work. When deadlines are missed, heavy fines begin to accumulate the longer the seller has to continue supporting the sold asset’s IT infrastructure. Furthermore, the faster you can help the organization realize cost synergies with the integration, the sooner they can communicate those savings out to shareholders, increasing the market’s perceived value of the M&A deal.

- Challenge: TSAs are often established WITHOUT IT’s involvement by M&A executives. That means the timelines to transition over an Active Directory (AD) domain, or perform a tenant to tenant Office 365 migration as part of an M&A or a divestiture is set by people who don’t know how to scope or resource this work. The challenge is clear, you’re expected to perform the work of IT integration in a tight timeline with a lot of unknowns.

- Prevent user disruption during the integration

- Importance: While working to meet these tight timelines, IT must effectively plan and perform the integration work while limiting the impact to user productivity.

- Challenge: This is a tall ask because an IT integration has a lot of moving parts and people. You need to set up trusts between Active Directory Forests to get organizations collaborating, but you must minimize security risks. You need to migrate content and yet continue to make it available so the two organizations can collaborate on new service offerings.

- Protect the business and customer data from potential security incidents

- Importance: Even if IT integration goes smoothly without disrupting users and within TSA timelines, the value of the deal and the perceptions of the market will take a huge hit if a cybersecurity incident hits the headlines.

- Challenge: Mergers are ripe for attackers to infiltrate an organization without anyone noticing. The door is constantly swinging open and closed between the two organizations involved in an M&A. It’s easy to miss the fly that slips in. In some cases, the acquired company may already be breached and your standard security analysis may miss this because you don’t have enough of a baseline to identify abnormal behavior.

- Communicate effectively to all stakeholders involved

- Importance: As mentioned earlier, IT integration has a lot of moving parts and a lot of people who must be in the know on the status of each phase of the project in order to keep the project moving forward effectively and on time.

- Challenge: M&A executives will want to know the status of meeting Legal Day 1 (LD1) and TSA timelines. Other IT teams are performing parallel execution like setting up AD trust, co-existence, or setting up SharePoint groups. Employees need to know how the IT integration will impact their day-to-day work. And finally, you need to communicate with HR on who is going and who is staying past LD1 as you plan user cutovers or cutoffs. That’s a lot of communication channels; a miss in one can have a domino effect in the rest jeopardizing timelines, costs and security.

Prepare for the onslaught of M&As with a repeatable IT integration framework

Given the increase in M&As, you will likely experience several IT integration projects in your career. So how do you prepare for these deals when you aren’t even brought in on them before they are signed?

The best defense as a good offense – right? So even if you aren’t privy to the M&A deal until after it is signed, you can still anticipate the project by building out a repeatable IT integration framework that includes the people, processes, and products needed to streamline, increase its success and minimize its impact on your own IT roadmap.

According to Gartner, “Serial acquirers often develop so-called “M&A playbooks” that contain standard processes and IT tools to reduce the time required to integrate, while minimizing operational disruptions and improving the quality of harmonization results.”

A repeatable IT integration framework needs to have the people, processes and products to cover these three areas to be successful:

- Day 0: IT Due Diligence: Understand, analyze and assess the entire Microsoft environment of the acquired or divested organization, while maintaining focus on the business needs and establishing baselines and procedures.

- Day 1: IT Integration Execution: Scope, plan, secure and execute both Legal Day 1 coexistence integration and end state consolidation. Monitor your environment for insider threats and unusual access or changes to data after the Day 1 transition. Then maintain productivity through the migration while detecting and diagnosing potential problems.

- Day 2: Ongoing business: Optimize cost synergies and efficiencies in the security and management of your new environment with the same framework used to facilitate your speed to execution in the migration

Learn more about how to approach an M&A IT Integration process for your hybrid Microsoft environment, including hybrid Active Directory, Exchange, SharePoint and Office 365 in this whitepaper: “IT Integration Best Practices in Mergers and Acquisitions.”

Sources:

- Thompson Reuters. Mergers & Acquisitions Review: Financial Advisors: Full Year 2018, 2019.

- Deloitte. Informed IT Integration: Three-phase approach can boost M&A synergy capture, 2017.

- Gartner, Inc. The CIO’s Role in Making Mergers and Acquisitions Faster, Ansgar Schulte,

Refreshed 5 December 2018, Published 1 February 2012.